A global watershed moment, the Covid-19 pandemic has reshaped our behaviours dramatically in a short space of time and has acted as a catalyst for innovation and digitalization. Indeed, the global health crisis has been a wakeup call for treasury management professionals such as CFOs and treasurers, many of whom were accustomed to managing their business financial operations on manual platforms such as excel spreadsheets.

Data from Asset Benchmark Research’s (ABR) Treasury Review 2020, conducted during the early part of this year, revealed some shifts in the way treasury management professionals have been approaching technology usage during these difficult times. Implementation of ERP (enterprise resource planning) systems regionally or globally for instance increased from 60% of participants last year to 71% this year, with SME participants experiencing the biggest rise in ERP usage from 51% to 63% in the past year.

The uncertain conditions of the pandemic may also have contributed to the slight increase in interest around using mobile devices for corporate banking services. In 2019, 43% of participants interviewed used or were planning to use corporate mobile banking services versus 48% recorded in 2020. The markets of Hong Kong (54%) and Singapore (60%) had the highest proportion of treasury professionals using mobile corporate banking services compared to other locations in Asia.

.png)

In terms of usage, the majority of participants used corporate mobile banking services for account and transaction inquiries similar to last year’s data. However, there was interestingly an increase of mobile payments and collection services, suggesting that there is a growing acceptance of companies using mobile money or e-wallet services to provide instant transfers to different parties.

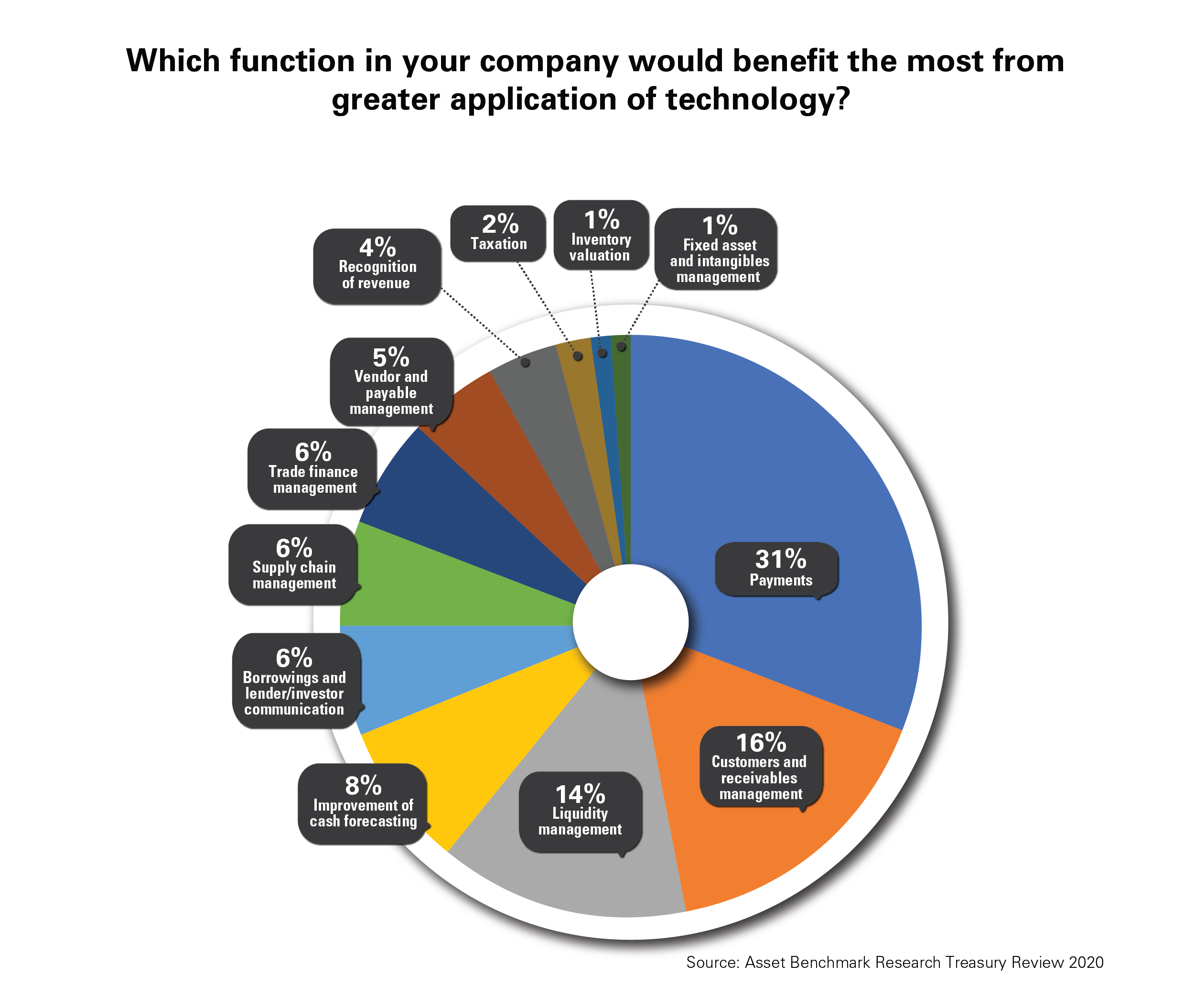

Conversely, payment processes for the second year in a row, were the most popular (31%) function expected to benefit from digital disruption. If social distancing measures are prolonged beyond this year, expect a greater demand from companies wanting to conduct digital payments. Interest in payment processes disruption was followed by customers/receivables management (16%) and liquidity management (14%).

Instability caused by the pandemic’s economic impact has also prompted companies to prepare for the worst, placing greater importance on financial forecasting and risk management models. Key to allowing this is having real-time data from a number of sources across an organization and the ability to rapidly interpret the data.

ABR’s Treasury Review 2020 supports this view, revealing that artificial intelligence and big data, respectively, were the top two emerging technology tools treasury professionals would like to hear more about. Appeal differed slightly depending on the market, with mainland China and Taiwan based respondents more interested in big data solutions compared to Hong Kong and Singapore participants, who were more interested in using artificial intelligence to solve their treasury pain points.

“We are seeing if business processes can be further automated or digitalized so that the lives of business users can be improved. We also want to give real-time information to business leaders so that they can make better informed decisions. Digitalization is a key message we are driving throughout the group,” shares a Malaysia based CFO of a multinational chemicals company.

Awareness of application programming interfaces (APIs) appeared to grow over the past year being the third most popular technology tool participants in 2020 were interested to hear more about. This was especially true for Singapore based respondents, indicating that companies there were more receptive about increasing connectivity with their banking partners and stakeholders in the community such as third-party payment providers.

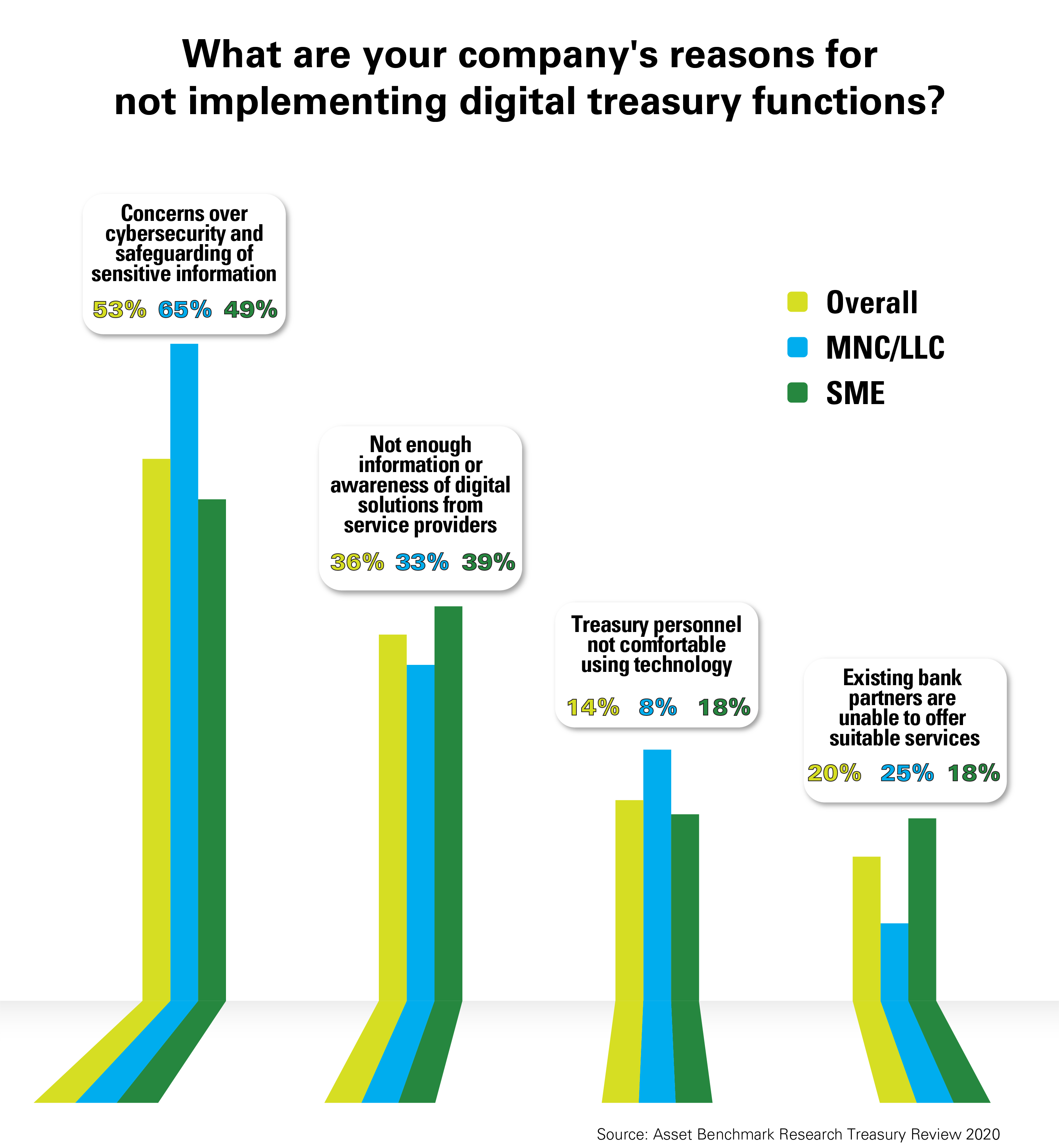

As with previous years, concerns over cybersecurity and safeguarding of sensitive information (53%) remained the top reason why treasury management professionals did not pursue digital projects, followed by not having enough information on digital solutions (36%) and bank partners being unable to offer suitable services (20%). SMEs differed from larger companies with a greater proportion suggesting that existing bank partners weren’t able to offer suitable digital services.

However, expect this skeptical mindset to change for both companies and banks as the uncertain conditions caused by the pandemic require more digital interactions. Sooner or later, companies will have to face tough decisions over balancing digital adoption risk with ensuring their business can run as usual in the post-pandemic world.

About Asset Benchmark Research’s annual Treasury Review

Conducted since 2013, ABR’s Treasury Review surveys corporates across Asia on an annual basis to understand the challenges faced by corporate treasurers and CFOs and the solutions they consider best suited to navigate financial markets. In 2020, around 700 corporate finance representatives participated in the survey, led by financial decision-makers in Greater China, India and Singapore. Based on annual turnover, 47% of respondents are small and medium-sized enterprises (less than US$250 million turnover per annum), 21% are mid-caps (US$250 million to US$1 billion turnover per annum) and 32% are large corporations (more than US$1 billion turnover per annum).