Technology will play a key role in the development of infrastructure in the Asia-Pacific in the coming years. Although the pandemic disrupted projects at the height of the health emergency during the second and third quarters of 2020, the focus on infrastructure as a pillar to restart economic activity in the region remains.

This was the key takeaway at the part one of The Asset’s 6th Sustainable Infrastructure Finance Leadership Series: Infrastructure Reimagined: State of Play. The webinar attracted attendance from 23 countries from the Asia-Pacific, Europe, UK, and North America including project sponsors, investors, financial institutions, and regulators from the region.

Indeed, as the region moves to the next phase, sustainable infrastructure will become a critical component of that strategy as governments, project sponsors, and investors accelerate the integration of environmental, social, and governance ( ESG ) factors into their assessments.

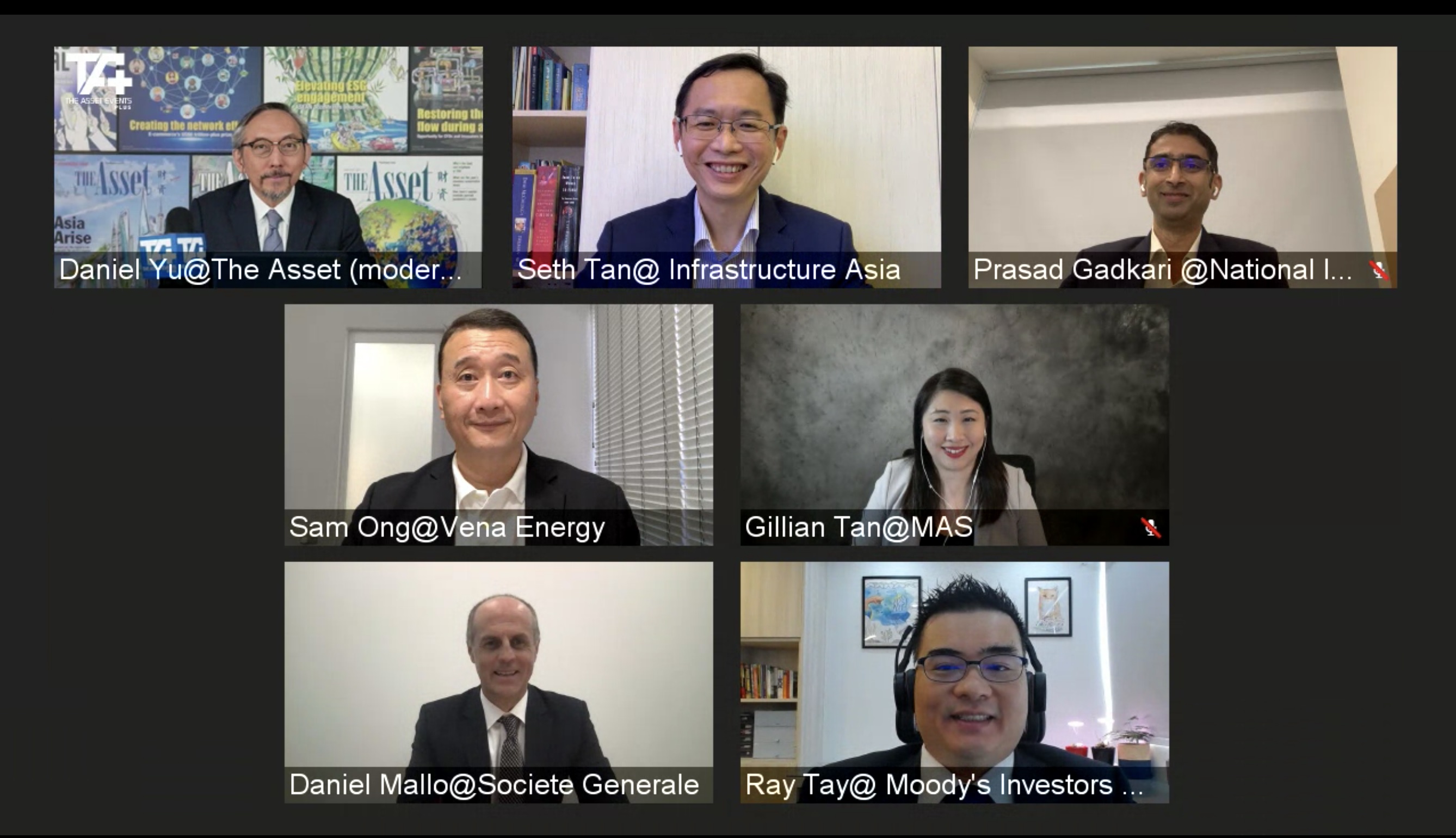

Sharing their views at The Asset Events+ webinar were Gillian Tan, assistant managing director, development and international group, at the Monetary Authority of Singapore; Seth Tan, executive director, Infrastructure Asia; Prasad Gadkari, executive director and chief strategy officer, National Investment and Infrastructure Fund; Sam Ong, chief financial officer, Vena Energy; Ray Tay, senior vice-president, project and infrastructure finance group, Moody's Investors Service; and Daniel Mallo, managing director, head of natural resources & infrastructure, Asia Pacific, at Société Générale.

In ten years, Asia has become the world leader in terms of renewable energy capacity accounting for 46% of the global total in 2020 from less than 33% at the start of the decade. The region’s renewable energy output in 2020 is twice that of Europe and more than four times that of the United States.