Hong Kong’s suspected digital fraud rate has exceeded the global level for a fifth consecutive year, a trend that highlights vulnerabilities exacerbated by the city’s rapid digital adoption and increasingly sophisticated cybercriminal tactics, according to a recent survey report.

Notably, 6.2% of all attempted digital transactions where the consumer was in Hong Kong were suspected to be digital fraud in 2024, 15% higher than the global rate of 5.4%, finds the H1 2025 Update to the State of Omnichannel Fraud Report published by global information and insights company TransUnion.

More notably, among consumers surveyed in 18 countries and regions for the report between November and December 2024, almost one in three ( 29% ) say they lost money due to online, e-mail, phone call or text messaging fraud in the last year.

In Hong Kong, 29% also say they lost money due to fraud at an average cost of US$4,332 ( HK$33,500 ) per person. This figure, the report notes, significantly surpassed the global average of US$1,747 ( over HK$13,600 ), positioning Hong Kong with the third-highest average amount of reported fraud loss across surveyed international markets.

Retail, communities, financial services top targets

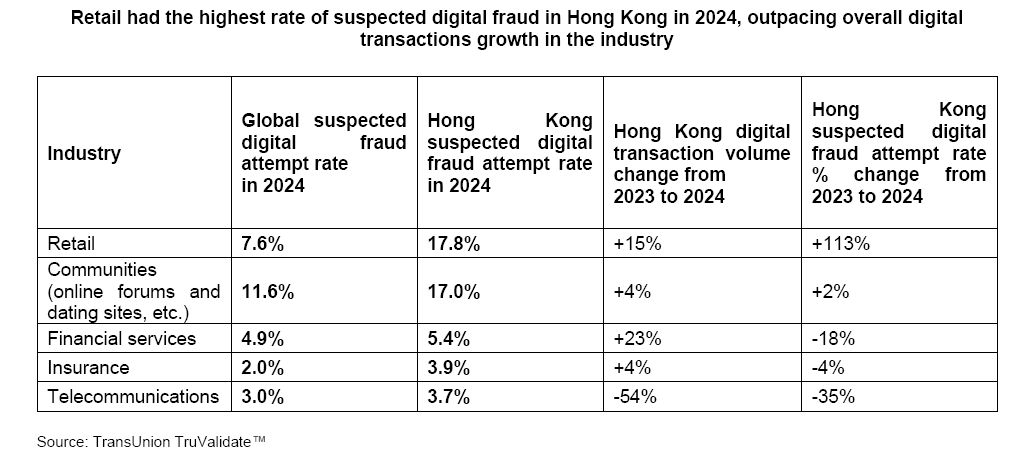

In 2024, the retail industry recorded the highest suspected digital fraud rate at 17.8% for transactions where the consumer was in Hong Kong. It represents, according to the report, a staggering 113% year-on-year ( yoy ) increase, the largest increase in the suspected digital fraud rate from 2023 to 2024 for retail among all countries and regions analyzed. This rapid increase also far surpasses the yoy digital transaction growth of 15% within the sector, suggesting a heightened likelihood of fraudulent activities outpacing overall industry growth.

This trend, the report points out, echoes local data from the Hong Kong Police Force, which recorded almost 12,800 online shopping fraud cases in 2024, resulting in losses of over HK$356 million, an increase of 43% in cases and 87% in financial losses compared with 2023, underscoring the pressing need for enhanced safeguards in the retail ecosystem.

The communities industry, which includes venues like online dating and forums, came close behind with the second-highest suspected digital fraud rate in Hong Kong at 17.0%, followed by financial services at 5.4% in 2024.

Although financial services remained among the top three industries most targeted by suspected digital fraud in Hong Kong, this rate has significantly decreased by 18% yoy ( down from 6.6% in 2023 ), even as the number of digital transactions in financial services in Hong Kong increased by almost one fourth ( 23% ).

This digital fraud rate decrease may be attributed to various measures implemented by the Hong Kong government, such as the expansion of Suspicious Account Alert for internet banking and physical branch transactions, which has bolstered customer protection against rising fraud risks.

Despite these findings, fraudsters, the report cautions, are highly adaptable, constantly evolving their tactics to target unprepared victims. Businesses and consumers must stay vigilant and informed about the latest fraud trends to avoid being deceived.

Since local banks implemented measures to combat malware in February 2024, according to the Hong Kong Monetary Authority, fraudsters swiftly shifted to schemes that trick victims into revealing SMS one-time passwords for ongoing fraudulent activities.

“With the average reported fraud loss in Hong Kong exceeding HK$33,500 – far surpassing the latest median monthly local income of HK$22,000 – the situation certainly needs greater public attention,” notes Eric Cheung, TransUnion Asia-Pacific’s head of solution consulting. “While combating fraud remains the city’s primary goal, stronger collaboration among regulators, businesses and consumers is essential for the effective mitigation of risks. We look forward to seeing more partnerships across various sectors to further enhance our defenses collectively.”

Concerns rise along with online transactions

Among Hong Kong consumers, the report highlights, there a growing reliance on online transactions. Close to one in three ( 32% ) respondents reported conducting more than half of their finance, retail and business transactions online, an increase from 27% in 2023.

Among generations surveyed ( Gen Z, millennials, Gen X and baby boomers ), Gen Z respondents demonstrated the most significant shift, with almost one in two ( 44% ) conducting more than 50% of their transactions online, a rise from 30% in the previous year.

With rising online transactions, 95% of Hong Kong respondents expressed concern about falling victim to fraud, highlighting the widespread apprehension and the necessity for businesses to enhance protective measures against online deception throughout the digital journey.

Among those who indicated they were targeted by e-mail, online, phone call or text messaging fraud within the last three months ( 51% ), phishing ( the use of fraudulent e-mails, websites, social posts, QR codes, etc., meant to steal data ) was the leading type of fraud experienced by respondents in Hong Kong since TransUnion began conducting this survey in 2022, suggesting a persistent trend.

“While the city’s rapid digital adoption has unlocked immense economic opportunities and consumer convenience, it has also exposed vulnerabilities that sophisticated cybercriminals are actively exploiting,” Cheung adds. “Although consumers are increasingly aware of potential digital fraud in conducting transactions online, according to our report findings, some still unfortunately became victims.

“To sustain business growth by effectively addressing consumers’ rising digital needs, it is crucial for businesses across all industries to leverage broader data and analytics, actively safeguarding themselves and their consumers by adopting friction-right fraud prevention solutions.”