Chinese assets have become an attractive option for Asean investors seeking to diversify their global portfolios amid the shockwaves unleashed by the US tariffs, suggesting China and Southeast Asia are bound to further strengthen the interconnection of their trade and financial markets.

Earlier this month, Shanghai Stock Exchange ( SSE ), in association with China Galaxy Securities ( CGS ), launched an online roadshow targeting Asean investors. It is the first in a series of Asean-focused events that the bourse operator is holding to attract more long-term capital into China’s equity markets.

“We are seeing great interest from Southeast Asian investors in Chinese equities during the roadshow,” says Angela Cheng, chief macro strategist and head of research at CGS International, in a speech keynoting the roadshow.

“Institutional investors like sovereign wealth funds, pension funds, and asset managers are showing an increasing appetite for RMB-denominated assets,” Cheng tells The Asset in a phone interview, elaborating on the investment trend.

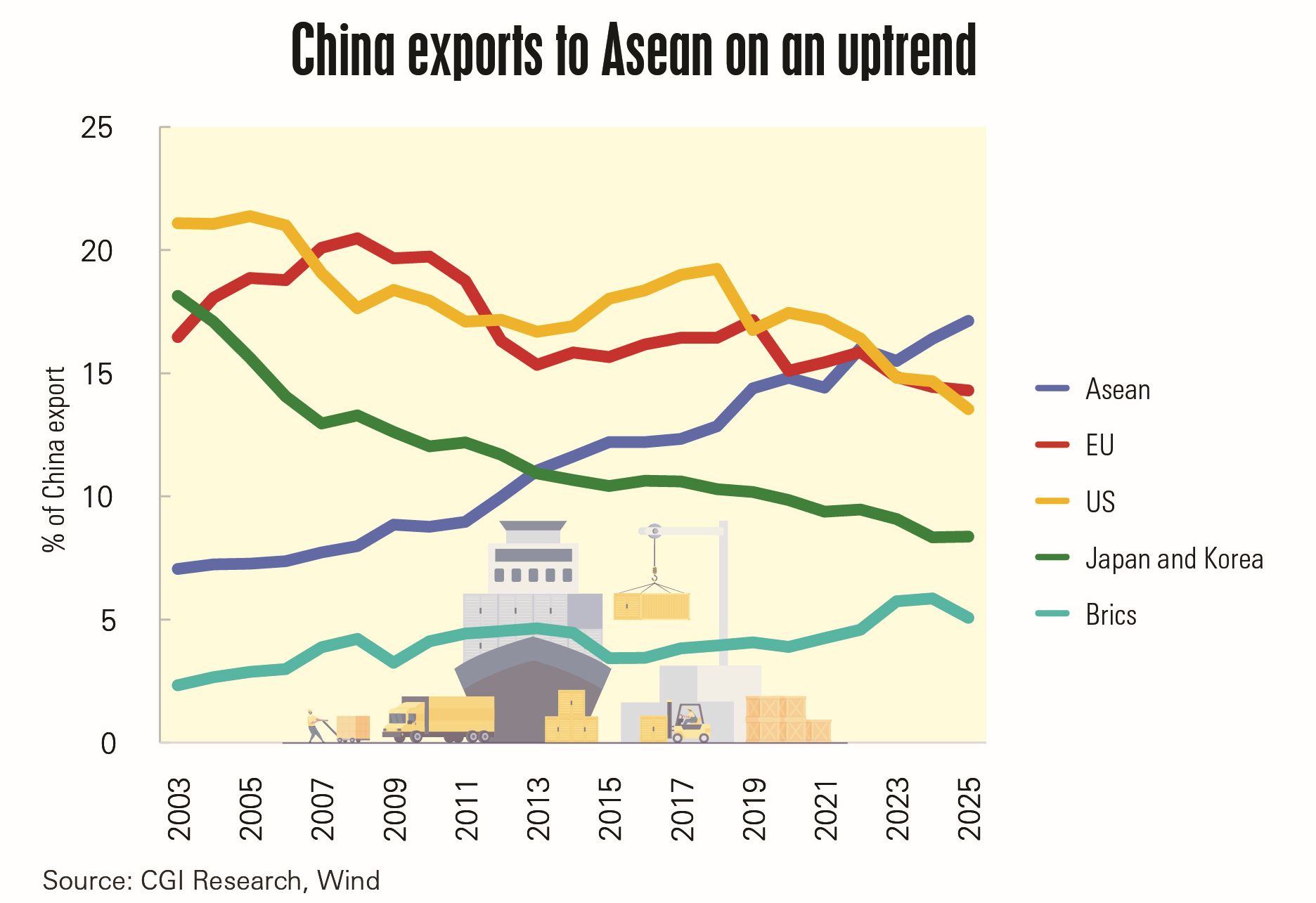

The share of China’s exports to Asean countries has been rising steadily over the past two decades. Since 2023, Asean has overtaken the European Union to become China’s largest export market. And as Chinese corporates expand their footprint overseas, China’s foreign direct investment ( FDI ) to the region continues to rise, reaching US$25.2 billion in 2023, according to data from the Ministry of Commerce.

Robust foundation

Following US President Donald Trump’s announcement of “reciprocal tariffs” on trade partners, Chinese President Xi Jinping and Premier Li Qiang visited Asean countries in April and May, respectively, to underscore the importance of multilateralism in international relations.

Most recently, the People’s Bank of China ( PBoC ) signed memoranda of understanding with the central banks of Indonesia and Thailand to establish a framework for cooperation to promote bilateral transactions in local currencies. This is expected to result in a regional local currency settlement network and promote the renminbi’s internationalization.

These initiatives create a robust foundation for financial market collaboration between China and Asean. Channels to access Chinese capital markets like A-shares, H-shares, and exchange-traded funds ( ETFs ) are becoming increasingly attractive to Asean investors amid rising economic and geopolitical uncertainties.

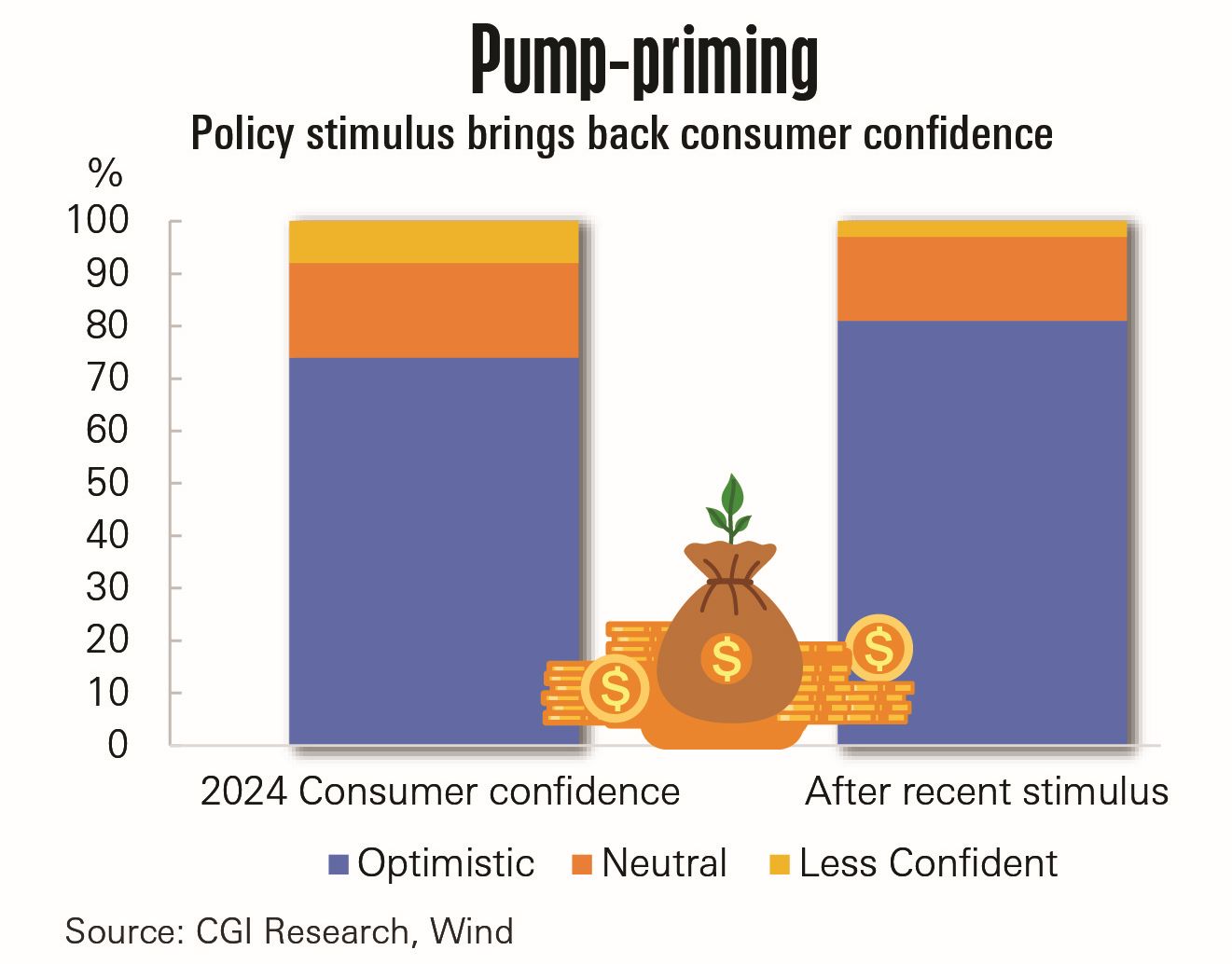

“The rebound of Chinese equities following the policy stimulus in September 2024 has helped to recover investors’ confidence in China,” Cheng shares. “The sensation from DeepSeek’s large language model earlier this year also strengthens investors’ long-term bet on China’s tech industry.”

“Of course, technology is not the only sector that thrills. Healthcare, electric vehicles, and consumption are also popular themes on the watchlist of overseas investors. There are signs of structural changes in the valuation of Chinese equities, and stronger policy stimulus will sustain the momentum,” Cheng adds.

Gaining favour

The revaluation of Chinese assets can be seen in the red-hot performance of Hong Kong’s initial public offering ( IPO ) market, with new listings on the main board of the Hong Kong Stock Exchange ( HKEX ) having raised over HK$76 billion ( US$9.7 billion ) so far this year. Landmark IPO deals include Mixue, China’s leading freshly-made drinks brand, in March, and CATL, the world’s largest electric vehicle battery maker, in May.

Aside from equities, fixed income products are also gaining favour, and have become core holdings of Asean institutional investors, according to CGS International. Indonesia’s Investment Authority and Malaysia’s Khazanah, both sovereign wealth funds, have increased their allocations to A-shares and RMB bonds. The scale effect of China’s market and its low correlation with other emerging markets help investors diversify market risks and optimize portfolio returns.

Asean investors take long positions on Chinese assets not only because of their perceived stability at the macroeconomic level but also because of their strong fundamentals at the micro level.

Meanwhile, Chinese companies have seen robust performance in Southeast Asian markets.

Pop Mart, a Hong Kong-listed Chinese toy maker, reported sales in Southeast Asia surged 619% to 2.4 billion yuan ( US$333 million ) last year, accounting for 47.4% of its overseas revenue.

Its Labubu series of plush toy monster elves was an instant hit in the region and elsewhere, becoming a craze among youngsters and celebrities who collect them despite the relatively high prices they fetch. “We can feel the fondness for Labubu among Southeast Asian consumers,” Cheng shares.

Huge potential

Another success story comes from Mixue Group, whose expansion into Southeast Asia started back in 2018 and has become the largest freshly-made drinks brand in the region since 2023 in terms of the number of stores opened and cups of drinks sold. The company also sees enormous growth potential in Southeast Asia's freshly-made drinks market, which it estimates at a compound annual growth rate of 19.8% from 2023 to 2028, surpassing China’s 17.6%.

Other famous Chinese brands, such as CATL and electric vehicle maker XPeng, have also announced plans to expand into Southeast Asia.

Facing global economic and geopolitical headwinds, China and Asean are strengthening their relations in economy and trade, industrial and supply chains, as well as capital markets.

Looking ahead, CGS reckons that trade cooperation will deepen in areas such as electronics, new energy, infrastructure, and the digital economy. On the investment side, interconnectivity mechanisms will be a key trend in the future, the state-owned brokerage and investment bank says, citing the ETF interconnectivity project between SSE and Singapore Exchange, which will be replicated in Indonesia and Thailand.