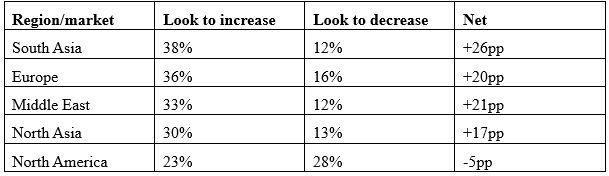

The Asian trade map would look drastically different should trade uncertainty persist, with 38% of Asian firms looking to trade more with South Asia, 36% to trade more with Europe, 33% to trade more with the Middle East – but 28% to trade less with North America ( NA ), according to a recent survey.

Notably, 83% of Asian firms say that trade policy changes are forcing them to rethink their long-term business model, while 81% say that trade uncertainty has made them more cautious about expansion and investment, finds HSBC’s 2025 Global Trade Pulse Survey, which offers insight into the business plans and sentiment of 2,750 international firms across seven Asian markets regarding tariffs and trade.

Asian firms, the survey also reveals, expect an average decline in revenues of 18% due to supply-chain delays. That said, 87% of Asian firms feel confident about growing their international trade over the next two years.

In light of current trade dynamics, Asian firms are more likely to increase trade with South Asia ( +26 percentage points ), the Middle East ( +21 ) and Europe ( +20 ). At the same time, they are more likely to decrease trade with North America ( -5 ).

Survey question: In light of current trade dynamics, how would you best describe your business’ trade strategy in relation to the following regions and markets?

Over the next two years, 52% of Asian firms are considering or in the process of moving production to ( or increasing production in ) China. The equivalent figure for South Asia is 39%; for Europe, 35%; US, 29% and Middle East, 28%.

Currently, the biggest concern to Asian firms ( 51% ) is rising costs due to tariffs and other trade-related factors. And 34% of Asian firms have adjusted prices to reflect higher costs, with 51% of Asian firms planning to do so. In addition, 37% of Asian firms have increased their inventory levels to manage supply disruptions, while 49% are planning to do so.

During the current period of trade disruption, Asian firms find cash and liquidity management as the most helpful form of support in managing working capital ( 61% ), followed by improved payment terms with buyers and suppliers ( 55% ) and supply-chain finance ( 51% ).

“Against a backdrop of trade uncertainty, many companies have taken a pause on their capital expenditure so that they can assess the new normal,” says Aditya Gahlaut, the bank’s regional head of global trade solutions for Asia. “Capex is never an overnight decision, but what is constant is that wherever trade flows, investment always follows.

“Working capital has become a high-priority C-suite agenda item for many clients because much of it is now trapped in either inventory or receivables. Ahead of tariffs being announced, many buyers frontloaded and raised their stock levels as a means to mitigate potential supply-chain disruptions, which caused a build-up of inventory at the buyer’s end.

“Once tariffs came into effect, many orders and shipments were either suspended or cancelled, leading to a build-up of inventory at the supplier’s end.”