China’s financial regulators have called for a further deepening of economic and financial cooperation between Hong Kong and the mainland, particularly within the Guangdong-Hong Kong-Macao Greater Bay Area ( GBA ).

Speaking at the 2025 Global Financial Leaders’ Investment Summit in Hong Kong on Tuesday ( November 4 ), Lu Lei, deputy governor of the People’s Bank of China ( PBoC ), reiterated the central bank’s full support for Hong Kong’s development as an international financial centre.

He notes three key areas of focus: “continuing to deepen financial market connectivity between Hong Kong and the mainland; actively supporting Hong Kong’s offshore renminbi ( RMB ) market; and enhancing integration in areas such as account opening, cross-border payments, and credit reporting services.”

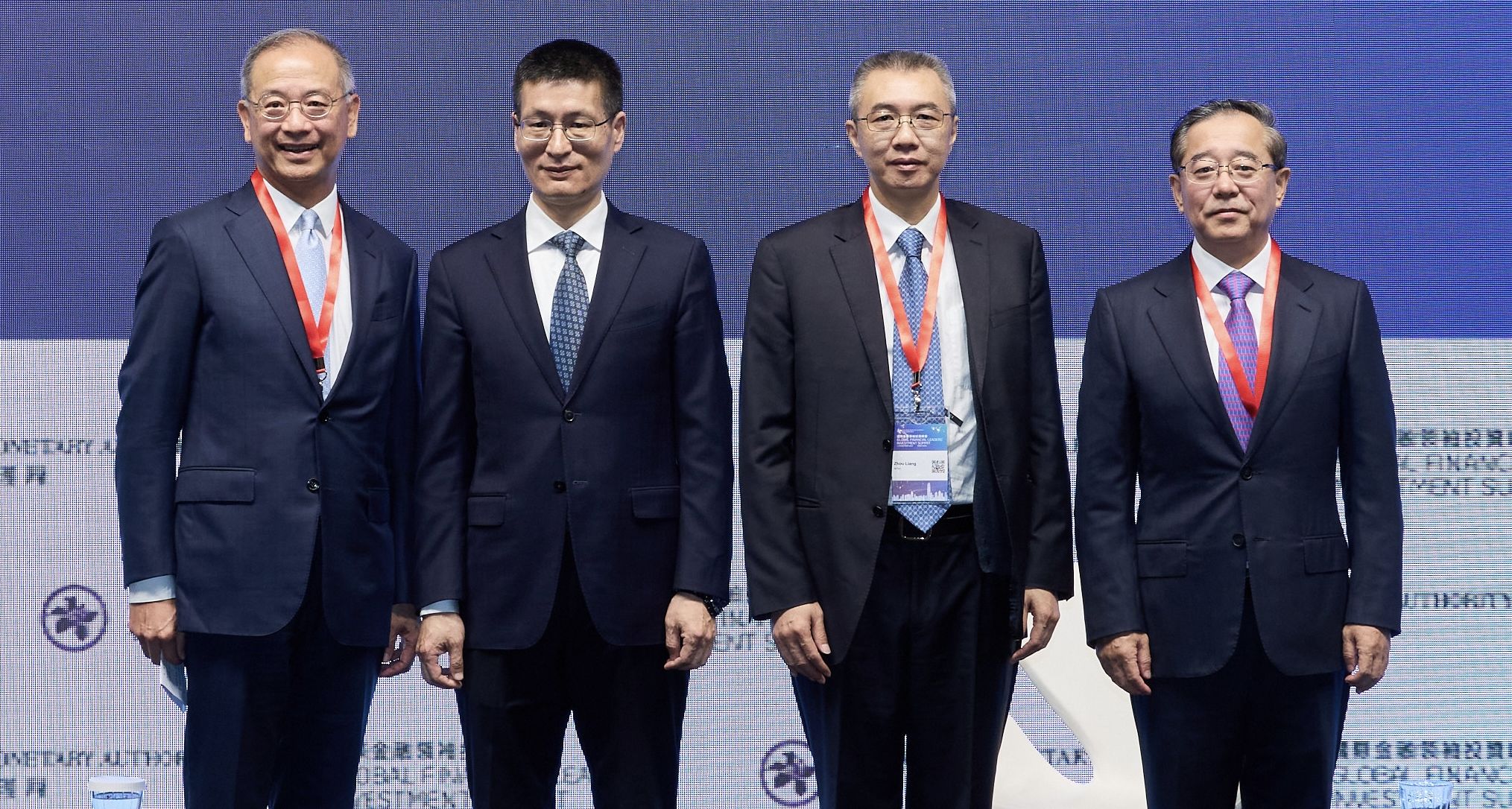

At the Investment Summit: ( From left ) Eddie Yue, chief executive of the Hong Kong Monetary Authority; Lu Lei, deputy governor of the People’s Bank of China; Zhou Liang, vice minister of the National Financial Regulatory Administration, and Li Ming, vice chairman of the China Securities Regulatory Commission. ( HKMA )

At the Investment Summit: ( From left ) Eddie Yue, chief executive of the Hong Kong Monetary Authority; Lu Lei, deputy governor of the People’s Bank of China; Zhou Liang, vice minister of the National Financial Regulatory Administration, and Li Ming, vice chairman of the China Securities Regulatory Commission. ( HKMA )

As of September 2025, 1,176 overseas institutions from 80 countries and regions have entered the mainland bond market with total holdings of 3.8 trillion yuan ( US$533.3 billion ).

As of July, more than 164,600 individual investors have participated in the Wealth Management Connect scheme, recording remittances of 120.9 billion yuan. The Swap Connect programme has processed more than 15,000 transactions as of August, with a notional principal of about 8.15 trillion yuan, according to the PBoC.

In the gold market, Bank of China ( Hong Kong )’s designated vault for the Shanghai Gold Exchange International Board became operational in June 2025, further strengthening Hong Kong’s position in international precious metals trading.

Financial infrastructure connectivity is also expanding. As of September, the Cross-Border Interbank Payment System ( CIPS ) has 113 direct and indirect participants in Hong Kong. The system continues to enhance trade and financing convenience, cross-border QR code payments, and broader GBA financial linkages.

Cooperation between mainland and Hong Kong credit agencies is also deepening. By the end of September, 78 Hong Kong-funded enterprises in Shenzhen have obtained 2.1 billion yuan in bank financing through credit information sharing.

“While encouraging financial connectivity, it is also necessary to build joint supervisory frameworks and strengthen cross-border risk prevention,” says Zhou Liang, vice minister of the National Financial Regulatory Administration.

Attracting 'patient' foreign capital

Also during the summit, mainland regulators expressed optimism that stronger market fundamentals and stable performance in A-shares would attract "more patient, long-term foreign investors".

In a video keynote address, He Lifeng, vice premier of the State Council, says China’s economy continues to show steady progress and high-quality growth. In the first three quarters of 2025, China’s GDP grew 5.2% year-on-year, keeping the country on track to achieve its 14th Five-Year Plan ( 2021-2025 ) targets.

So far this year, major Chinese stock indices have maintained stable upward momentum. The total market capitalization of listed companies has surpassed 119 trillion yuan, with technology firms accounting for more than 25% of that total. Average daily trading turnover in the Shanghai and Shenzhen markets has reached 2 trillion yuan, reflecting renewed investor confidence.

“In the first half of this year, both revenue and net profit of A-share-listed companies increased year-on-year. In the first three quarters, cash dividends reached 12.1 trillion yuan – a record high for the same period,” says Li Ming, vice chairman of the China Securities Regulatory Commission ( CSRC ).

“Annualized volatility has fallen to 14.1%, down 6.1 percentage points from last year. As stability becomes a key factor in asset allocation, China’s resilient economy and capital markets will continue to offer unique investment opportunities. We encourage global investors to understand the value of China’s modernization, seize opportunities, invest in and grow with China,” Li adds.

Meanwhile, Hong Kong’s initial public offering ( IPO ) market has also performed robustly in 2025. Hong Kong Chief Executive John Lee notes that Hong Kong ranks first in IPO fundraising globally this year, highlighting the city’s strong ability to attract capital and listings.

Serving as a vital bridge between mainland and international markets, Hong Kong continues to strengthen its role in fostering long-term foreign investment and deepening financial integration in the region, Lee adds.