There’s been a lot of attention in the media and the blogosphere in recent days on the success of efforts to boost gender and other elements of diversity in the workplace, to coincide with International Women’s Day ( IWD ) on March 8.

Like other fixed dates in the calendar to commemorate, celebrate or bring attention to just causes, IWD is an opportunity to take stock of where we’ve got to in promoting what used simply to be called equal opportunities ( before the narrative became radically politicized ).

If nothing else, the timing of the announcement by the UK’s two principal financial services regulators, the Financial Conduct Authority ( FCA ) and the Prudential Regulation Authority ( PRA ) that they had abandoned plans to publish rules on diversity and inclusion ( D&I ) was, let’s just say, interesting.

I wrote in The Asset about plans to regulate diversity and inclusion in UK financial services ( Pushing the line on diversity disclosure ) back in 2021 after the FCA had launched a consultation on proposals to improve transparency for investors around the diversity of listed company boards and their executive management teams. I suspected then that approach could easily have headed the wrong way down the dead ends of virtue signalling, box ticking and political correctness.

Today’s back story is not so much the DEI ( diversity, equity and inclusion ) backlash emanating from the US, but partly the UK government’s lurch for growth ( not going so well given the 0.1% contraction in UK GDP in January ) and the light-touch, low-cost approach to regulation it has adopted to achieve it. Partly also the realisation that hard-coding something as amorphous as D&I in a granular manner in regulatory text is fraught with difficulties.

No quick wins

Above anything else, it’s impossible for firms to change the make-up of their senior leadership teams or boards quickly to make them more diverse. That takes time, progressive succession planning and sustained strategies that capture the long tail of attracting, training, retaining and promoting a diverse set of talented employees – talented being the operative word as merit has to run through the core of any corporate strategy, D&I or otherwise.

In basically identical letters to Meg Hillier MP, chair of the UK parliament’s Treasury select committee, the heads of the PRA and FCA both confirmed that they are ditching plans to introduce D&I rules, even though both agencies believe regulatory intervention can play a useful role. In his letter, FCA chief executive Nikhil Rathi noted that D&I can “deliver improved internal governance, decision making and risk management, and can support the competitiveness of UK financial services”. Sam Woods, his PRA counterpart, wrote that D&I “can support both safety and soundness – through reduced risk of group-think”.

But both agencies concluded that it should be up to firms and their boards to develop and own their diversity and inclusion strategies, which on balance I think is probably right. While promoting equal opportunity in the workplace is presumably uncontroversial, it’s at the same time hard to see how forcing a firm to comply with aspects of diversity via regulatory diktat would be workable, certainly in the short to medium term. Or what level of non-compliance should attract what sort of regulatory penalty.

Firms’ strategies can’t be allowed to happen in splendid isolation, however. While there is no such thing as ‘one-size-fits-all’, the D&I narrative will be better served if it is supported by best-practice codes, principles and guidance crafted by regulators and monitored by supervisors.

These should ensure that targets and strategies are supported ( as proposed in the 2023 joint FCA/PRA consultation to boost D&I ) by appropriate risk and control functions, and by data collection, standardization, monitoring and reporting to facilitate industry benchmarking. And strategies must be owned by leaders and boards, not HR.

The 2023 joint consultation had proposed mandatory disclosure on the age, sexual orientation, sex or gender, long-term health condition, ethnicity and religion of regulated firms’ employees. The PRA acknowledged at the time that it would be very difficult to quantify the benefits of proposed measures. And it pointed out that while there is a lot of research around the benefits of diversity, not all of it has been conclusive, and indeed in some cases it has been mixed. So, both agencies will now align with policy and legislative agendas elsewhere ( they didn’t specify where ) on employment rights, gender action plans, and disability and ethnicity pay-gap reporting.

Limited progress in Europe

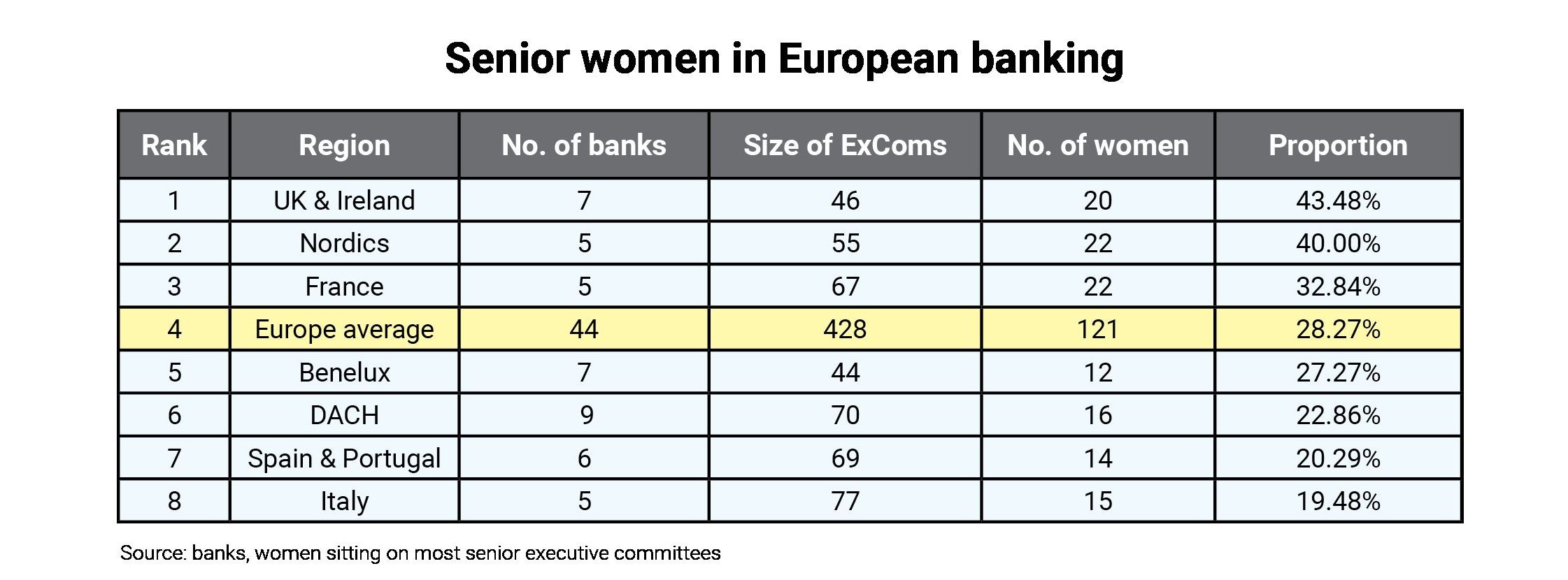

On a related note, I was curious to see how far the gender make-up of senior leadership teams had changed in European banking over the past two years. I’d reviewed the composition of the senior executive committees of Europe’s large banks and national champions a couple of years back so I repeated the exercise in recent days to track progress. My review covered the most senior executive ranks of 44 of the largest banks in Europe. I came up with the following simple top-line findings:

Of the 428 executives sitting on the banks’ most senior executive committees or management boards, two in seven ( 121, or 28.27% ) are women. When I did the same exercise at about the same time in 2023, the count was 132 out of 531, or 24.86%. That’s mathematical progress, I guess. Of the 121 women in today’s senior ranks, roughly two-thirds, or 78, are the same as in 2023.

But there is one less woman today at the helm of a large banking group. In early 2023, there were five among the banks I looked at: Françoise Thoma ( Banque et Caisse d’Epargne de l’Etat ), Kjerstin Braathen ( DNB ), Alison Rose ( NatWest ), Ana Botín ( Santander ), and Carina Åkerström ( Svenska Handelsbanken ).

Botín, Braathen and Thoma remain in situ, while Bettina Orlop has ascended to the CEO slot at Commerzbank and Rose and Åkerström have moved on, making for just four. [At group subsidiary level, Elena Goitini was and still is CEO of BNL, BNP Paribas’ Italian subsidiary, while Marion Höllinger is CEO of Hypoversinsbank, UniCredit’s bank in Germany.]

And while there is a handful of female CFOs among Europe’s largest banks, broadly unchanged, around three-quarters of the most senior women bank executives occupy central services roles. Few run business lines. There is a proportionally much higher number of women running HR ( 14 out of 44 banks ), or serving as chief risk officers, chief operating officers, as heads of compliance, marketing, communications, strategy, legal, sustainability or the customer experience.

Long story short, it’s impossible to ascribe any changes to diversity or related strategies. First, because banking is a very fluid industry; senior executives – men and women – constantly move to other firms, retire or leave for any number of reasons. Second, the size and composition of management boards and executive committees change over time as a result of reorganizations, restructurings, simplifications, mergers, acquisitions, or for business-model-related reasons. So, the numbers don’t really tell the story beyond evidencing a direction of travel. In Europe, banking is facing the right way but the truck is hardly accelerating.